Analysis of the Russian market of crystal oscillators

1. World market of quartz oscillators.

Unfortunately the data for 2019 is not yet available in open sources. The global piezoelectric crystal market totaled $ 2.94 billion in 2018, table 1. Annual revenue and shipments declined between 2017 and 2018, driven by a weak consumer electronics market and economic and trade uncertainty.

Table 1. Global market of quartz oscillators

|

Place 2018 |

Place 2009 |

2009, mil usd |

2017, mil usd |

2018, mil usd |

Changes, % |

Market share in 2018, % |

|

|

1 |

EPSON |

1 |

655 |

382 |

365 |

-4,5 |

12,4 |

|

2 |

NDK |

2 |

597 |

354 |

358 |

1,1 |

12,2 |

|

3 |

Kyocera |

4 |

317 |

344 |

285 |

-17,1 |

9,7 |

|

4 |

TXC |

4 |

223 |

294 |

272 |

-7,5 |

9,3 |

|

5 |

KDS |

3 |

343 |

205 |

191 |

-6,8 |

6,5 |

|

6 |

SIWARD |

15 |

46 |

104 |

95 |

-8,7 |

3,2 |

|

7 |

Hosonic |

9 |

110 |

98 |

94 |

-4,4 |

3,2 |

|

8 |

Harmony |

|

n/a |

98 |

90 |

-8,2 |

3,1 |

|

9 |

DIODES |

13 |

53 |

n/a |

90 |

n/a |

3,1 |

|

10 |

MegaChips |

|

n/a |

103 |

85 |

-17,4 |

2,9 |

|

|

Others |

|

n/a |

1289 |

1015 |

-21,3 |

34,5 |

|

|

Total |

|

|

3271 |

2940 |

|

|

CS & A source

The top 10 manufacturers accounted for 65.5% of the global market in 2018. If you are choosing a company for a distribution agreement among the market leaders pay special attention to the places of companies in 2018 and 2009, especially those that have maintained sales volume. They have not just maintained, they have increased their market share. Indirectly this indicates technological and price leadership. Look at figure 1 from the presentation of the company “TXC”.

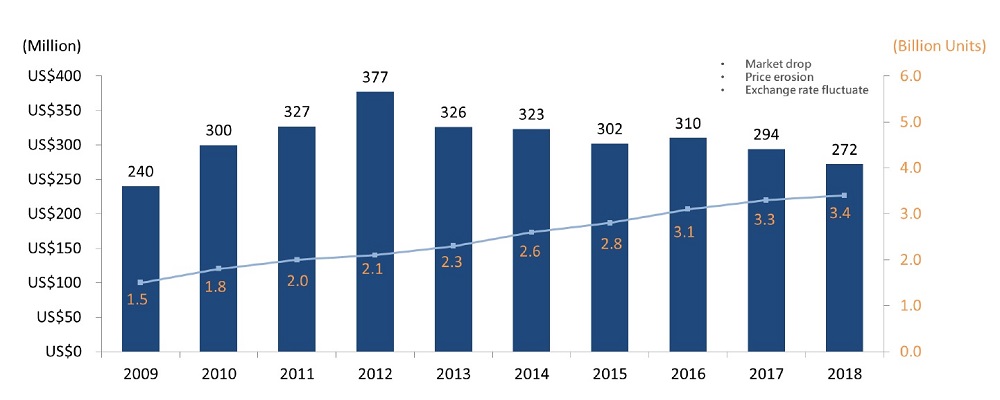

Figure 1. Sales of the company “TXC” by volume and in pieces.

Yes their sales volume has not increased much in 10 years due to the fact that the price of the crystal has been falling all the years, but they managed to double the production of products in pieces.

According to the site crystalmarketreport.com there are many different types of quartz oscillators. The market can be divided into several types: TCXO type, VCXO type, OCXO type and Others type. TCXO Type is the most frequently used and efficient type occupying 52.32% of the market in 2018.

By its application Automotive is the largest consumer group. The aerospace industry occupies only 6.4% of the market in 2018. The consumer electronics market share in 2018 is 19.4% and it will grow rapidly from 2019 to 2025. In 2018 medical equipment occupies 9.6 % of the market. The market share of information technologies and telecommunications in 2018 is 15.1%. Other industries have a market share of 15.6% in 2018.

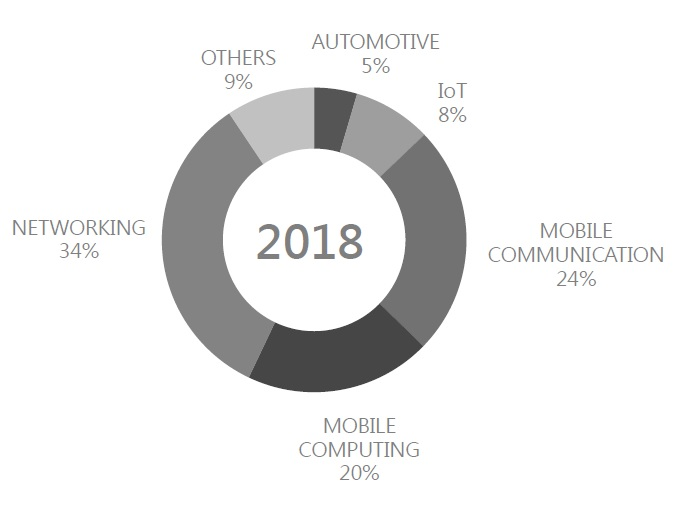

In figure 2 you can see the actual sales structure of the company “TXC” taken from the corporate presentation.

Figure 2. “TXC” revenue by market segment

If you are a developer or manufacturer just find yourself in this circle.

I’m sure most of you will only be in a couple of segments.

The market of the use of piezoelectric crystals in Russia is very limited but in the global market the main players expect an increase in consumption. Drivers include high demand for quartz oscillators in the telecommunication, consumer electronics and healthcare sectors.

Telecommunication systems such as SONET SDH require high-stability system synchronization to prevent time spikes or data loss. Healthcare devices require the use of quartz oscillators in such products as pacemakers and this, along with other similar innovations, is expected to drive demand for quartz oscillators in this market in the long run.

Consumer electronics products include televisions, radios, cell phones, cordless phones, computers, pagers, video recorders and so on. A typical smartphone or tablet requires up to five generators and with the increasing use of combined Wi-Fi and Bluetooth chipsets in smartphone applications the growth of quartz oscillators may increase.

Overall given the growth in the number of applications the consumer electronics segment is expected to see the strongest potential growth.

The greatest danger to the market is represented by integrated MEMS oscillators, especially where it is necessary to ensure the minimum size and achieve a reduction in consumption.

However quartz syncing devices have a long and successful history. This is a mature and well-developed technology with a key advantage that MEMS components have yet to gain: quartz material is very stable over a wide temperature range. This is an important factor for devices that must operate at typical temperatures from -40 to + 85 °C.

However just look at the sales structure of the company “TXC”, figure 2, to understand that for Russia, MEMS oscillators have an even narrower market than conventional quartz resonators.

2. Russian market of piezoelectric devices import

Import to Russia is carried out under the customs code 8541600000, piezoelectric crystals collected. You can see the results for brands in table 2.

Table 2. Top 12 manufacturers by code 8541600000

|

Manufacturer |

Total, usd |

|

NDK NIHON DEMPA KOGYO |

1218487 |

|

RAKON |

1040307 |

|

ABRACON LLC |

591031 |

|

GEYER |

539164 |

|

EPSON |

537401 |

|

KDS DAISHINKU COR |

480248 |

|

CONTINENTAL AUTOMOTIVE GMBH |

476444 |

|

SHENZHEN CRYSTAL TECHNOLOGY |

462713 |

|

BS&BIG |

456518 |

|

MURATA |

391223 |

|

TAI SAW |

350084 |

|

GOLLEDGE ELECTRONICS |

328729 |

A total of 13,100,000 usd worth of imports were imported to the Russian Federation under this code. The volume of the crystal import market, compared to the world market, looks just microscopic which is directly related to the sales structure shown in figure 2. In Russia there is simply no majority of electronic production where piezoelectric crystals can be used. You can see the structure of brands by import volume in table 3.

Table 3. The structure of brands by volume

|

Thousand, Usd |

Brands |

mil, Usd |

|

from 500 |

5 |

3,9 |

|

from 100-499 |

22 |

5,4 |

|

from 10-99 |

115 |

2,8 |

A special feature of imports under this code is that many ready-made devices are supplied to Russia which include piezoelectric crystals. Especially a lot of such devices go to the automotive market and sensors. Examples of such devices are given in table 4.

Table 4. Brands and examples of products containing piezoelectric crystals

|

Brand |

Note |

|

CONTINENTAL AUTOMOTIVE GMBH |

AIRBAG SENSOR PIEZOELECTRIC |

|

API MARINE APS |

CONSTRUCTIVELY CONSIST OF SEVERAL LAYERS OF PIEZOCERAMIC PLATES WITH A DIAMETER OF 16 MM MOUNTED ON A SCREW WITH 2 WASHERS |

|

YUJIE TECHNOLOGY LIMITED |

PIEZOELECTRIC CRYSTALS ASSEMBLED FOR ENGINE KNOCK SENSORS |

|

ILN BUSAN |

CYLINDRICAL SENSOR WITH METAL SLEEVE AND PIEZOELECTRIC PLATE |

|

SMART MATERIAL GMBH |

SPREADING IN THE METAL CAN BE REFLECTED FROM DEFECTS (CRACKS, PORES, SLAG INCLUSIONS) |

|

GUANGDONG CHANGHONG ELECTRONICS |

FOR INDUSTRIAL ASSEMBLY OF W / C (LCD) BRAND TVS… |

In general such devices account for about 20% of import. In essence this is not the Russian market, since the cost of the crystal itself in the device is a small percentage and the production of the product is not carried out in Russia.

Most consumers are interested in standard components. Therefore we will take only electronic component distributors from table 5.

Table 5. Top recipients of import by volume

|

Importer |

Total, usd |

|

|

1 |

Distributor |

993766 |

|

2 |

Distributor |

588011 |

|

3 |

Auto manufacturer |

479238 |

|

4 |

Distributor |

442425 |

|

5 |

Manufacturer |

421813 |

|

6 |

Distributor |

353614 |

|

7 |

Distributor |

333212 |

|

8 |

Manufacturer |

272935 |

|

9 |

Manufacturer |

269494 |

|

10 |

Distributor |

269489 |

|

11 |

Distributor |

268709 |

|

12 |

Manufacturer |

262787 |

|

13 |

Distributor |

228035 |

|

14 |

Customs broker |

224356 |

|

15 |

Manufacturer |

222860 |

Let’s make a list of distributors and put brands on it. As a result we will get a list of brands in table 6 imported to Russia by distributors of electronic components.

Table 6. Top 14 brands that have distributors of electronic components in Russia.

|

Brand |

Import, usd |

|

NDK NIHON DEMPA KOGYO |

1218000 |

|

RAKON |

1040000 |

|

ABRACON LLC |

591000 |

|

GEYER |

539000 |

|

EPSON |

537000 |

|

KDS DAISHINKU COR |

480000 |

|

SHENZHEN CRYSTAL TECHNOLOGY |

462000 |

|

GOLLEDGE ELECTRONICS |

328000 |

|

RF360 TECHNOLOGY |

214000 |

|

SILICON LABORATORIES |

198000 |

|

MICRO CRYSTAL |

164000 |

|

VECTRON/MICROCHIP |

162000 |

|

DIODES/PERICOM |

125000 |

|

TXC CORPORATION |

107887 |

An attentive reader may ask where did BS&BIG with 456000 or TAI SAW with 341000 and other brands get lost? They are not included in the table as they are delivered directly to one or at most two manufacturers. Yes, the volumes are large, but you can’t buy them in Russia, they are not in Russian warehouses, they are not imported by distributors. If you can’t consume 100,000 usd there may be a lot of difficulties with deliveries when starting production.

If you are planning to implement quartz in the device and do not want problems with supplies, I recommend paying attention, first of all, to table 6.

The following table 7 shows where the goods imported into Russia under the customs code 8541600000 were produced.

Table 7. Country of origin.

|

Country of origin |

Total |

|

China (CN) |

4886148 |

|

Japan (JP) |

1574484 |

|

Taiwan (China) (TW) |

1529691 |

|

United States (US) |

834570 |

|

South Korea (KR) |

830160 |

|

France (FR) |

702289 |

|

Thailand (TH) |

504761 |

|

Germany (DE) |

465621 |

|

EU (EU) |

406183 |

|

New Zealand (NZ) |

378728 |

Interestingly that despite the fact that the top four leaders in table 1 are Japanese companies, only 10% of devices are produced directly in Japan and most of them are made by one company.

Summing up we can state.

- Due to the specificity of quartz consumption segments in the electronic market global players are not interested in the Russian market.

- The Russian import market is small and amounts to about 11 million dollars.

- For global players, in the form of their shareholders and Board of Directors, our market simply does not exist. We simply do not have it in the consumption segment of figure 2.

Since most of the oscillators are manufactured in Asia, it is probably preferable for a new business to look for partners among medium-sized Asian manufacturers or directly Russian ones.

3. Russian manufacturers of piezoelectric devices

In the process of studying Russian manufacturers I found an interesting report of JSC “Plant “Meteor”. It was the most detailed and the most open.

The report states the following:

“The company’s main competitors in this industry in terms of activities. Domestic enterprises: JSC “Morion” (St. Petersburg); JSC “Lit-PHOnon” (Moscow); JSC “Piezo” (Moscow); JSC “Plant “Meteorit-N”.

I sent e-mails to two companies from the list but unfortunately I didn’t get a response.

The report says, data on the loading of the design capacity: in 2018, finished products were released, when loading production capacity when working in one shift: resonators – 192 thousand pieces; filters – 41 thousand pieces; oscillators – 16 thousand pieces. Total products – 249 thousand pieces, which is 33.6 % of the maximum possible result with 100 % load of the enterprise.

Reason for incomplete loading of the design capacity:

– reduction of the state budget;

– insufficient measures to control and promote the policy of import substitution of electronic components, implemented in government ministries and departments as well as in state-owned companies;

– slow transition of consumers from the use of imported components to modern domestic analogues, due to the high cost of conducting standard tests of equipment;

– the company’s design capacity is designed for production in a special period.

As I understand it, all these reasons relate to the closed market. It is difficult for me to imagine how and by what the state will be motivated to encourage the use of “Plant “Meteor” products on the civilian market. And the last point causes a smile – war that whether has to begin. However I repeat, the report itself, with some exceptions, is the pinnacle of openness and data provision. The vast majority of Russian companies do not even provide a presentation for clients or simply do not have one. As one representative of the plant told me, their presentation is a trade secret. Here’s how, a presentation for clients is a trade secret!

I got a list of the plant’s competitors from the report. I have compiled the sales volume for 2018 of these companies, table 8. At the time of writing reports for 2019 have not yet been released. The average annual exchange rate of the Central Bank in 2018 is 62.9264 rubles per 1 us dollar.

Table 8. Revenue of Russian manufacturers for 2018

|

|

revenue RUB, mil |

usd, mil |

|

JSC “Plant “Meteor” |

489 |

7,8 |

|

JSC “PIEZO” |

156 |

2,5 |

|

JSC “LIT-PHONON” |

708 |

11,3 |

|

JSC “Morion” |

1 221 |

19,4 |

|

JSC “Plant “Meteorit-N” |

71 |

1,1 |

|

Total |

2645 |

42,0 |

Comment on the table.

- JSC “LIT-PHONON” revenue amounted to 932,090 thousand rubles, but only 81.1% of revenue was research and production activities.

- JSC “Morion” revenue amounted to 1477.9 million rubles. The development and manufacture of piezoelectric devices (quartz resonators, oscillators, filters and crystal elements) accounted for 88% of the company’s total revenue over the past two years.

- In JSC “Morion” the performance of commissioned research and development work amounted to 6%, based on this figure the author decided to deduct this percentage from all companies.

All of Russia accounts for 1187,000 usd of exports under the code 8541600000, which is 9% of imports or 2.8% of the total revenue of all Russian manufacturers in 2018.

Very interesting information is provided by JSC “Morion”.

Main activities of JSC “Morion” in 2018:

– Sales of crystal elements accounted for 4.5% of total sales;

– Oscillator sales – 55.5% of total sales;

– Sales of quartz resonators and filters – 25.0% of total sales;

– Sales of rubidium frequency standards – 2.6% of total sales;

– Execution of commissioned development work – 6.0% of total sales.

And now, my dear readers, I will deprive you of a sweet dessert. When you saw the figure of 42 million usd produced in Russia, you probably rejoiced. Wow, we did it! In general you are right, in the production of piezoelectric devices Russia clearly has a large technological reserve in the form of as many as 4 enterprises that actively compete with each other. But there is one but!

I’ll give you an example and you can draw your own conclusions.

I did not believe in the figure of 42 million but then I remembered that “Plant “Meteor” honestly writes that most of its products go to the military service.

“The company’s products finds its application mainly in aerospace and military technology of the Russian production. In the production of civilian products only a small part of the nomenclature is used.”

And I found the first supplies I came across. Between “Plant “Meteor” and JSC “IZHEVSK ELECTROMECHANICAL PLANT “KUPOL” and another in JSC ” PO “Electropribor” Penza.

The PK467-MH-7LC-16000K resonator shown in figure 3 was sold for 821 rubles including VAT in 2016. And the RK467MI1-7VN-25000 resonator in 2018 already cost 1,182 rubles with VAT. Please do not rush to swear, please note that this is Acceptance 5.

Acceptance 5 is a military acceptance. I do not know the specifics of pricing military acceptance, I am a specialist in the civil market, but I do know that military acceptance, in any country, is more expensive than civil. It may well be that this resonator should work in conditions of hard radiation and 100% humidity.

The same in the US, if we compare the price of a MIL JANTX diode of the quality category and exactly the same without JANTX, then the price is 100 times higher. (For example, compare prices for the JANTX1N5416 and 1N5416GP positions at global distributors).

I give the above example so that you can make a conclusion yourself how many times the cost of products for special use is more expensive than civil ones. This is real. Ask the engineer to select an analog for PK467 and look at the average price level.

To be honest, with such a difference in price, it is unlikely that they want to launch civilian products, because as honestly written in “Plant “Meteor”:

“The existing load of the new production facility (shop N94) created for the production of import-substituting components for surface mounting is insufficient and is about 10% of the design capacity”.

For the honesty of “Plant “Meteor” many thanks and even more respect.

I do not know what percentage of the cost of piezoelectric devices is used for housing but I do know that in diodes it is 90%.

I see it in “Plant “Meteor” report.

Currently the company has the following technological competencies:

– packaging, assembly, tuning and frequency tuning of quartz resonators, oscillators, filters (production volume of more than 500 thousand units per year).

Why have a 90% unloaded production? It can be more effective to buy crystal elements from market leaders, for the most popular names of imported products on our market, package them and sell them under its own brand. And when amounts will allow – to run the actual production. However to do this, you will have to legally divide sales into the civil and closed market. Otherwise nothing will work.

What else can I recommend?

Just send your employee, for 6 months, to work as a product manager in “Kompel”, “Semitron”, “Elitan”. These companies are 100% working with the civil market, we need to learn how to work with them, understand them. To work in the civil market you need to create structures that have never worked in a closed market. From my experience I can say that it is not possible to work in the civil market with people who have most of their sales, motivation and success coming from the closed market. These markets – civil and state – are so different, working so according to different rules that, in comparison, fire and water seem to be close relatives.