Market of Murata in Russia

Murata Manufacturing Co., Ltd. is a Japanese manufacturer of electronic components based in Nagaokakio, Kyoto. Murata Manufacturing mainly produces ceramic passive electronic components, primarily capacitors, and occupies a significant share of the global market for ceramic filters, high-frequency parts and sensors.

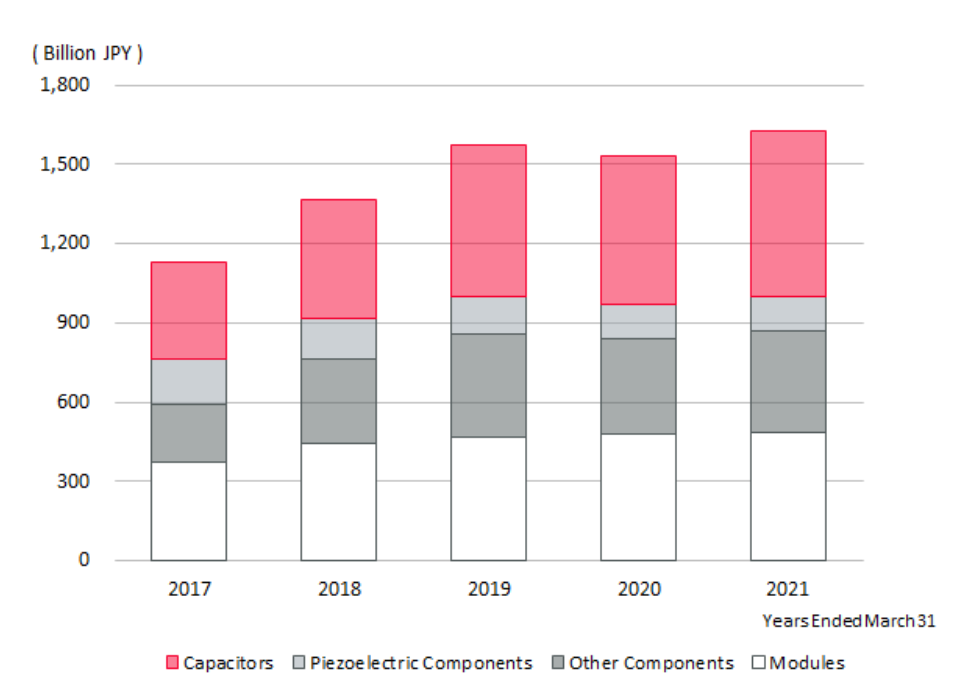

Figure 1 shows how sales are distributed by product groups. The official data are taken from the company’s website.

The company’s historical indicators represent interesting statistics.

The share of ceramic capacitors in the company’s sales increased from 33% to 38%, and in monetary terms – by 3 times. But the share of piezoelectric elements decreased from 15% to 8%, in monetary terms, the growth was only 50%. The share of China in the company’s sales increased from 41% to 58%. Import data to Russia from year to year are shown in Table 1.

Table 1. Import to Russia by Murata brand in 2017-2020

| Year | end result, FOB, usd |

| 2017 | 10 045 126 |

| 2018 | 18 044 242 |

| 2019 | 15 066 082 |

| 2020 | 12 337 937 |

In 2018, there was a shortage of Murata Manufacturing ceramic capacitors, which led to high rates of price growth and an increase in inventory. However, even considering the maximum sales figure of the brand in Russia, equal to 18 million, against the background of Murata’s total sales of 14 billion, the share of our country is quite insignificant, which fits into the statistical error and falls into the other countries column.

If you refer to the article in the magazine The KiT No. 12, 2008, you will find out that the former representative of Murata did not refute the figure of 1% of the brand’s sales in Russia from the world. Indirectly, this means that the company’s share in Russia has greatly decreased. The article announced the company’s sales goal – $15 million.

The structure of brand import to Russia, see Table 2.

Table 2. Import to Russia in 2020 by Murata brand and by component groups

| Type | Amount |

| Ceramic capacitors | 6,243,375 |

| Inductors and chokes | 2,437,742 |

| Converters | 1,653,237 |

| Other | 1,152,135 |

| PIEZOELECTRIC CRYSTALS ASSEMBLED | 371,826 |

| 11,858,314 |

An attentive reader has noticed the difference between the result of Table 2 and Table 1. I’m not occupied with figures fitting and always try to show real statistics. The full import figure, in fact, gives an idea of the market only to global producers. My internal task is to assess the competitive market, not the whole, so my figures may differ from those provided by companies analyzing the market without restrictions. Table 1 contains all the import options in which Murata is the manufacturer. It is quite common practice when one manufacturer produces something for another one. In this case, some of the data that seemed superfluous to me has been removed. So, Murata is indicated as the manufacturer, but the brand, although well-known, is different. Further analysis will be carried out according to Table 2.

Further, it is important to note that a significant share of supplies comes from the recipients of LG ELECTRONICS RUS, LLC and SAMSUNG ELECTRONICS RUS KALUGA, LLC. In total, they import for the amount of $1 million.

I will take the liberty to remove the supplies for these companies in order to get a more trustworthy result. They are not a competitive environment for local regional suppliers, they are global direct deliveries. After their removal, the revenue from the business of Murata in Russia will amount to $10.8 million.

Further analysis will be carried out based on this figure.

According to the annual report, the sales of Murata multilayer ceramic capacitors increased by 12% in 2020. The company plans to repeat the result next year. Such indicators are caused by the growth in sales of smartphones and automotive electronics, due to an increase in the number of devices, the transition to 5G and further electrification.

In Russia, the sales of Murata ceramic capacitors are declining, despite positive consumer feedback about the brand. Two aggressive players, SAMSUNG and YAGEO, put competitive pressure on MURATA in Russia. In 2019, the brand Murata confidently held the first place for ceramic capacitors expressed in monetary terms, but parity with competitors was already observed in pieces. I note that 5 years ago Murata exceeded them by 2 times in terms of income. Nevertheless, Russia has no influence on the sales situation in general.

Norio Nakajima, the President of Murata, said in an interview with Nikkan Kogyo Shimbun that, at least in the next 3 years, the growth rate of the overall MLCC market was expected to be above 10%, and Murata would continue to increase production to meet the demand. Norio Nakajima added that now, due to the global shortage of semiconductors, many customers were significantly increasing their MLCC inventory levels. It is expected that the price of MLCC may decline after market stocks are sufficient in the second half of the year.

Last time the company was engaged in a takeover in 2014. It is important for the analysis of imports and allows us to assert that all brand products were delivered in 2020 under the brand Murata, as an impressive period of 6 years had passed.

The Russian distributor of the brand Murata, presented on the official website of the company, is only the company Symmetron.

More than 100 importers have imported Murata brand products to Russia in the amount of $ 10,000 or more, I will divide them into 2 groups. Table 3 will show only TOP 25 suppliers I found, and Table 4 will show only manufacturers. In both cases, the data is reliable, only the suppliers and manufacturers with websites (if any) are considered. Contract manufacturers and transport companies are presented in a separate table.

Table 3. TOP 25 importers-suppliers of Murata in Russia in 2020

Table 4. TOP 25 importers-manufactures of Murata in Russia in 2020

| Table 3 | Table 4 | ||

| Importer’s place | Amount | Importer’s place | Amount |

| 1 | 1,529,936 | 1 | 562,795 |

| 2 | 1,516,548 | 2 | 281,391 |

| 3 | 708,008 | 3 | 275,230 |

| 4 | 204,793 | 4 | 130,453 |

| 5 | 170,788 | 5 | 109,942 |

| 6 | 166,678 | 6 | 91,484 |

| 7 | 156,718 | 7 | 73,356 |

| 8 | 137,105 | 8 | 66,770 |

| 9 | 135,677 | 9 | 58,408 |

| 10 | 134,532 | 10 | 54,812 |

| 11 | 126,724 | 11 | 53,331 |

| 12 | 115,369 | 12 | 51,607 |

| 13 | 104,216 | 13 | 48,888 |

| 14 | 103,848 | 14 | 48,434 |

| 15 | 100,626 | 15 | 45,629 |

| 16 | 97,519 | 16 | 44,719 |

| 17 | 92,298 | 17 | 34,971 |

| 18 | 79,300 | 18 | 34,548 |

| 19 | 75,210 | 19 | 33,657 |

| 20 | 71,429 | 20 | 32,793 |

| 21 | 69,377 | 21 | 31,943 |

| 22 | 68,902 | 22 | 25,778 |

| 23 | 64,064 | 23 | 24,147 |

| 24 | 58,683 | 24 | 22,578 |

| 25 | 55,943 | 25 | 18,249 |

| Others | 876,350 | Others | 106,357 |

| Total result | 7,020,641 | Total result | 2,362,270 |

Table 5 shows all other importers not included in Tables 3 and 4.

| Type | Amount |

| Customs broker, contract manufacturing, IT Distributor, ??? | 882,274 |

| Others <10000 | 590,166 |

| Total result | 1,472,440 |

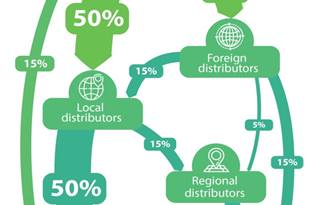

Most of the import of the amount $10.8 million (at least 65%) are carried out by the intermediaries. It is noteworthy that the first place in the list of intermediaries is occupied by regional Russian distributor of Murata – the company Symmetron, and is not the only one regional distributor. I admit that a customs broker or a separate legal entity imports products for them, but it is impossible to verify this information. If you have information about this matter, please write to correct the figures. According to official data, Symmetron imports only 13% of all Murata imports to Russia. It is an extremely low figure for a single local distributor. At the same time, Symmetron leads only in the supply of converters, and its share in the import of capacitors and coils is significantly less. I’m not surprised by this fact, I had experience with the managers of this company on a number of issues, and I got the impression that Symmetron has a special individual business model with its advantages and disadvantages.

Global distributors send about half of the import to Russia. I can assume that one of the main problems of Symmetron company is the difference in pricing, that it cannot compensate, as its model does not allow to buy Murata products from other companies. It turns out that the share of import of non-distributor supplies of Murata products is approximately 30-35%. What conclusion can we make?

Symmetron, while developing Murata sales, deliberately does not use the benefits of its work, or the brand itself does not the company to do so. I think the second option is more likely. On the other hand, I am sure that the board of directors in Murata evaluates sales in Russia not separately, but in the column others for the region EMEA.

Perhaps an additional hidden reason for such a low import share is that Symmetron is also a distributor of Epcos, an old competitor of Murata. Its sales are almost 2 times higher than Murata’s sales in Russia.

Subscribe, maybe my next article will be about Epcos.

Unfortunately, my request to the company Symmetron remained unanswered.