Ceramic capacitors market: opportunities for Russia

About four months ago I talked to the representatives of the passive components consortium and the publishing house Electronics: STB. In a conversation, the representative of the publishing house expressed an idea that interested me: what if we analyze the market not from the point of view of distributor competition, but from the point of view of the manufacturer? Following the idea I expressed my thoughts that it would be interesting to give the opinions of manufacturers complete control over the second part of the article. Let them tell us whether we are able to produce it competitively. The key word is competitive, and not for national security. And although the meeting itself was not continued, the topic of the article interested me personally.

I decided to take ceramic capacitors for analysis. Why?

Firstly, this is a relatively simple production and it does not require such capital investments as a factory development using 28nm technology or the production of a processor which characteristics are comparable to an AMD chip, in furtherance of which the developer of the Russian processors line Baikal has recently received two multibillion-dollar subsidies from the Ministry of Industry and Trade. Secondly, all types of capacitors cover up to 40% of almost any specification in general. The largest share in the total volume (pieces) is occupied by MLCC (multilayer ceramic capacitor).

For national security, control microchips are necessary. On the civilian electronic market, such insignificant elements as passive electronic components, transistors, logic, etc. have a greater impact on the cost of the product. They cover up to 90% of the specification and up to 70% of the cost of the product. Ceramic capacitors occupy the second place after resistors in terms of their presence on the board.

Ceramic capacitors include two custom codes: multi-layer and single-layer. We will analyze them in total. Year-wise import statistics are shown in Table 1.

Table 1. Import of ceramic capacitors to Russia.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Multi-layer | 18.5 | 16 | 26.5 | 48.9 | 37.7 | 36 |

| Single-layer | 1.45 | 1.5 | 2.4 | 2.6 | 3.1 | 3 |

| Total | 19.9 | 17.5 | 28.9 | 51.5 | 40.8 | 39 |

At the end of 2017 and during the whole year of 2018, there was a period of shortage of ceramic capacitors and the price increased by several times. In the first quarter of 2019, the deficit ended, prices fell down, but did not return to the previous level. Actually, a simple comparison of 2020 and 2016 clearly shows how much the monetary component of ceramic capacitors on the board has grown.

Let us consider 2020.

Step 1

Traditionally, we exclude two suppliers from the competitive environment, namely SAMSUNG ELECTRONICS RUS KALUGA and LG ELECTRONICS RUS. In total, they import $4.1 million. This figure is the sum of supplies from the procurement department of the manufacturers themselves to their own factories under international contracts. I doubt that our legislative initiatives will cause a positive reaction, since the component base is laid in the development process in the engineering centers of the companies themselves, which are not located in Russia. By the way, both of these plants, which also export their products, are a vivid example of the fact that the development of electronic production, and, consequently, the increase in the market of components, is a process of symbiosis, and should be considered in the development strategy as two parallel, but mandatory programs. However, here we will have to choose, either we legislatively increase the share of Russian components, or we attract electronics production to Russia, including contract production, but without any restrictions. This is possible in the future, now it is not a competitive market for us, minus $4.1 million.

Step 2

Since getting any data requires resources, I have chosen the import criterion from $200 per line. In the report I have received, there are no import figures less than $200 per line, but I can get their total amount. In total, lines less than $200 give $1.1 million.

These small purchases are an unavoidable component of our global market share. For example, there are 4,000 import lines from $200 to $500, and even more of those that are less than $200. What is $100 if you take a standard 0603 X7R 0.1 UF +10% 50V capacitor? This is about 50-70 thousand capacitors. For many Russian enterprises, this is annual consumption, and for SAMSUNG ELECTRONICS RUS KALUGA, this is the day of the plant’s operation. I record such small supplies as competitive, plus $1.1 million.

Step 3

First of all, we will identify the supplies by various intermediaries, which include both official distributors and independent suppliers. If these intermediaries, including distributors, supply products of various brands to our civilian market, then they can also supply our products, subject to competitive quality and price. To begin with, let’s evaluate the structure.

Table 2. Structure of importers by import amount

| Type | Importers | Amount, mln. USD |

| more than 1 mln. | 4 | 7.7 |

| 100 k – 1 mln. | 27 | 7.26 |

| 10 k – 100 k | 47 | 1.8 |

| 0.2 k – 10 k | 62 | 0.32 |

| IT Distributor | 6 | 3.1 |

| Customs Broker | 9 | 1.4 |

| Total | 155 | 21.58 |

In total, there are more than 140 intermediaries in my identification list, and their websites clearly say about the supply of electronic components. In Table 2, for clarity, you can safely add IT Distributors, such as MARVEL, in a separate line.

I also single out customs brokers in a separate line, but I classify them as intermediaries based on the breadth of the line. I may be mistaken, but in general it still looks more like civilian supplies. The evaluation of the share of intermediaries is very important, since ceramic capacitors are a stock assortment, their availability in stock is a guarantee of sale. No one will wait for a $100 supply of capacitors. Distributors smooth out the difference between the production time and the needs of customers, which is very important for our manufacturers, since the main problem of the Russian components, in addition to the price, is the inability to buy yesterday.

Step 4

We identify Russian manufacturers-importers. We will also include OEM and contract manufacturers in this category. In total, my list includes more than 91 manufacturers who imported ceramic capacitors for the amount of $10.2 million.

Step 5

The remaining $3.5 million is accounted for another 205 importers. Among them there are also such as BAKER HUGHES JSC, which supply the capacitors for their needs. There are not many of them in total, their share does not exceed $ 1 million. In this step, we will take $2.5 million as a competitive share.

In total, if we sum up the import figures, we get a competitive market for ceramic capacitors in Russia equal to $ 35 million. This is the maximum amount that Russian manufacturers can count on if they can produce their products at competitive prices, without taking into account the influence of the state in the form of restrictive legislative measures.

It is difficult for me to judge whether this amount is enough. I can refer to general practice, and in Table 3 give examples of countries where ceramic capacitors imported to Russia are manufactured.

Table 3. Source country of ceramic capacitors.

| Source country of the goods |

| China (CN) |

| Japan (JP) |

| Taiwan (China) (TW) |

| USA (US) |

| South Korea (KR) |

90% of all ceramic capacitors sold are manufactured in the above five countries (Table 3), which is not surprising if you break down the nuances.

- USA (US). This is AMERICAN TECHNICAL CERAMICS — almost all production is in the USA. One of the few countries that have retained the production of ceramic capacitors, although ATS company itself is a subsidiary of AVX, which, in turn, is a subsidiary of the Japanese giant Kyocera.

- The German divisions of TDK (EPCOS) do not manufacture ceramics in Germany, almost everything is made in Japan and China, although the most part of the shipment comes from Europe.

It turns out that the Russian market of ceramic capacitors, according to the location of the company’s headquarters, is divided into three countries — Japan, Taiwan and Korea. Most of the production of these companies is localized in China.

During one week I have read three contradictory news.

The first is that the country assigns more than $120 million for the development and production of a processor which characteristics are comparable to an AMD chip.

The second, Zenit Bank has collected 1.5 billion rubles of debt from the electronics manufacturer Angstrem. Few people know that these are not the first penalties. For example, Angstrem-T in court recovered the debts in the amount of about 108 million rubles from its erstwhile “sister” technology company Angstrem. Such judicial penalties are a direct path to default.

The third, the news about Rusnano’s pre-default status. For reference, the total volume of Rusnano’s bond issues is 71.58 billion rubles, in addition to bonds, the company also has obligations on bank loans. By the middle of 2021, they amounted to 76.4 billion rubles.

This alone wouldn’t be a problem, if only the corporation Nanoprojects brought profits instead of losses – the newspaper Vedomosti calculated that among 20 the largest they reached 6 billion rubles in 2020. It is obvious that the company has no chance of getting out of the debt pit and the state will have to make huge new infusion of money in addition to 400 billion rubles that Rusnano has already received from the state for its existence.

In my estimation, over the past 15 years, the state has invested at least $10 billion in the production of all types of electronic components with direct subsidies/loans/infusions alone.

The idea is correct, but the chosen path….From the point of view of national security, there are undoubtedly successes and very significant ones, but these infusions are not particularly noticeable on the civilian market yet.

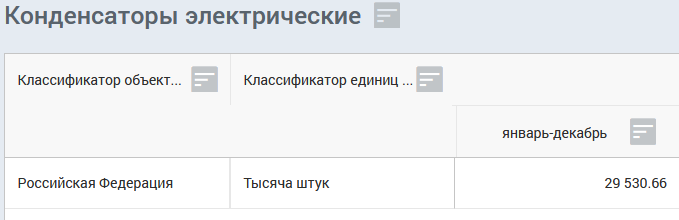

If you look at the Rosstat data, see picture 1, then you will see the following for 2020:

Picture 1. Rosstat data on the production of capacitors for 2020.

| Electric capacitors | ||

| Object classifier | Classifier of units | |

| January-December | ||

| The Russian Federation | Thousand pieces | 29,530.66 |

This figure includes all capacitors in Russia. It is very difficult for me to believe in this data, but if this is the case, then the state, paying close attention to the direction of processors and controls, forgets about the basis of any board.

But this is a symbiosis, development and production of electronics, contract manufacturing, electronic components production and export. Have you ever tried exporting electronic components? I have, it’s so strange that it is only profitable to export wagons with grain, and if a customer needs 10,000 pieces of capacitors, then it’s much more profitable and convenient for him to buy … anywhere but not in Russia.

But this is my personal civic opinion, let’s try to find out the opinion of people who understand much more about the production than I do. Additionally, we will give them introductory data on the calculations of five names of capacitors.

| FOB in China | From the distributor’s warehouse in Russia | |

| CL10B104KB8NNNC | 0.0015-0.002 | 0.0024 |

| CL21B105KAFNNNE | 0.005-0.006 | 0.0075 |

| CL21A106KOQNNNE | 0.006-0.007 | 0.009 |

| CL10B105KA8NNNC | 0.003-0.004 | 0.0054 |

| CL10A475KP8NNNC | 0.002-0.003 | 0.0038 |

These are the most popular names of ceramic capacitors. With a probability of 90% you will meet them on any board. If we take the maximum value of 0.009, then at least ceramic capacitors of all manufacturers and denominations for the amount of 4 billion are imported to Russia. Compare the figure with the figure in picture 1.

Questions for the manufacturers:

- Can we produce all denominations or is it better to focus on those 20% that bring 80% of income?

- Can we produce at competitive prices in the current tax system?

What if you give additional competitive advantages.

- What will happen to prices if you reset VAT and all taxes, except social contributions?

- What will happen to prices if it is additionally fixed at the legislative level that half of the import customs VAT paid according to the code of ceramic capacitors should be sent as support/subsidies to the enterprise producing ceramic capacitors (approximately $3.5 million per year).

The author of the comment is Sukhanov Dmitry Alexandrovich, Deputy Technical Director for products for semiconductor production of Ostek-EK LLC

“The quality of domestically-produced capacitors, compared with ATC, Murata, TDK, AVX, is a stumbling block for their application. Having worked as a developer of REA for more than 10 years, I can say with confidence that imported capacitors show the best performance in terms of reliability of operation, and also have the best functional capabilities with the same overall dimensions, and often even smaller dimensions.

The question is? And why should we use domestic products if they are:

a) more expensive;

b) they are not present in warehouses in the nomenclature that imported analogues are;

c) delivery period exceeds all reasonable and unreasonable limits if you want to order something.

The domestic capacitors can only be applied in those products in which it is simply impossible to install imported analogues. I cannot give reliable figures and compare the data with previous values, but these products, namely in the volume of capacitors, are negligible compared to civilian industry products. Yes, it should not be excluded. This is a targeted market segment with its own pricing, which is not affected by the presence of imported analogues. Currently, there are a number of domestic developments that are superior to imported analogues, but their nomenclature is extremely small. So isn’t it better just to make high-quality capacitors in the necessary nomenclature, that will not be inferior in terms of functional capabilities and dimensions to imported ones? Let them be more expensive than imported analogues, there is no talk about fighting “monsters” and Chinese production. And you can use this quality purpose-made product.

As for the competitive price and the production, the tax remissions will be exclusively temporary. But it is a big question whether it will be possible to pay off the cost of the equipment necessary for the production and make a profit during this time. At the same time, it should be taken into account that in my opinion it will be impossible to win market share from “monsters”, unless you supply the products by “wagons” and at a steal.

If the Russian manufacturers of ceramic capacitors read my article, I will be happy to post their opinion here. Unfortunately, it was not possible to get feedback using available contacts. In general, I will be glad to receive any opinion, write via feedback.