The Russian LED market

What do you need the analytics for?

Market analytic data makes it possible for us to enhance and expand our product range due to analyzing research results of popular product lines of well-known brands and our competitors’ market position. It helps to make right decisions on choosing an “acute” niche in the product range in question and to penetrate new market segments. The objective analytics makes it easier to find price-flexible suppliers. The analysis demonstrates competitors’ strategies, their supplies and product range. As well as enables you to monitor development of your companies and your own results of strategic actions taken on the market. Let’s take the Russian import statistics of LEDs and we’ll get the following situation shown in Table 1.

Table 1. Import to Russia according by code 8541* in April, May, June 2019.

|

HS Code |

Sum over the field Statistic value |

Description |

|

8541401004 |

7,461,386 |

Other inorganic light emitting diodes, except laser diodes |

|

8541401009 |

4,376,034 |

Other light emitting diodes (LED), including laser diodes |

|

8541401002 |

3,872,095 |

Inorganic light emitting diodes: light emitting diodes on a hard print board without semiconductor element, required for starting and steady operation of light emitting diodes, except laser diodes |

|

8541401008 |

2,431,767 |

Other light emitting diodes (LED), except laser diodes |

|

8541401001 |

344,719 |

Inorganic light emitting diodes: caseless light emitting diode chips, except laser diodes |

|

8541401006 |

168,422 |

Light emitting diodes (LED), infrared spectrum (emission wavelength exceeds 760 nm), except laser diodes |

|

8541401007 |

34,949 |

Light emitting diodes (LED), ultraviolet spectrum (emission wavelength less than 380 nm), except laser diodes |

|

8541600000 |

2,643,601 |

Piezoelectric crystals assembled |

|

8541210000 |

1,597,818 |

Transistors, except phototransistor with power dissipation less than 1W |

The two last codes are not related to LEDs, despite the fact that they are included in 8541. I left them here deliberately. I will analyze 8541600000 or 8541210000 in the next article, write your comments on which to choose, or subscribe on the site not to miss updates.

Please pay attention to the fact that these are data is for three months of 2019 – April, May, and June.

You can find the rest of the statistics at the end of the article, and now let’s start with a little bit of history. I am sure that you will be interested.

Monocrystal

A subsidiary of a diversified industrial concern Energomera. A global leader in manufacturing sapphires for the LED industry and consumer electronics, as well as metallization pastes for solar energy. The company exports over 98% of its products to more than 25 countries all over the globe. Over the past 5 years, Monocrystal has 9 times increased its production volume of synthetic sapphires, investing more than $220 million in capacity expansion.

Nowadays, the largest consumers of sapphire plates or substrates are LED manufacturers; however, in the late 1990s this market was still in its infancy. And Monocrystal started its activities with manufacturing sapphire glasses, which watch companies were ready to purchase. “During the first months, Monocrystal sales volume was unconvincing and amounted to $5-10 thousand per month,” says Polyakov, the company owner. Now, about 70% of the Monocrystal revenue comes from LEDs. The company is the market leader.

ZAO Svetlana-Optoelectronica

Svetlana-Optoelectronica used to be the only Russian company with a complete manufacturing composite cycle of LED products. The plant was built by OAO Svetlana-Led, which however failed to provide enough of manufacturing load.

Since 2000, Monocrystal began selling its first products to Europe; during 2001-2007, the managers invested in the enterprise modernization. Due to technical re-equipment, Monocrystal was able to make a breakthrough: in 2010, the company gained the revenue of about $90 million.

Until 2007, ZAO Svetlana-Optoelectronica produced lamps, fire alarms, based on LEDs with an infrared spectrum, performed scientific research and development projects on government orders – according to SPARK-Interfax, its annual revenue during that period amounted to $15–20 million.

Until 2005, both companies were small, but steadily operating. Everything changed in 2007. Dmitry Medvedev – Chair of the Government of the Russian Federation – supported the presidential initiative by prohibiting to use incandescent bulbs (from 2014 it will be necessary to completely replace them with fluorescent bulbs or LEDs). Since 2007, models of tablets, monitors, TVs and laptops with LED backlighting have been extensively introduced to the global market. From 1999 to 2008, global LED sales increased 6.2 times – from $820 million to $5.1 billion. The trend was clear.

What happened next

Table 2. The companies’ brief history.

|

|

Monocrystal |

Svetlana-Optoelectronica |

|

2007 |

The enterprise modernization completed. |

In 2007, Svetlana-Optoelectronica received a new co-owner – ZAO LEDinvest, whose ambitions involved the growing LED market |

|

2010 |

Around 2010, Polyakov introduced a procedure of selecting the best and the worst employees at Monocrystal. In 2010, the plant increased its revenue by almost 3.5 times, up to $89 million. |

ZAO LEDinvest increased its share in Svetlana Optoelectronica to a target figure. In 4Q 2010, the company’s revenue from selling LED bulbs amounted to 187 million rubles. This figure is 15.6 times exceeds the previous year’s. According to Alexander Stolyarov, CEO of Svetlana-Optoelectronica, the revenue forecast for 2011 is 1 billion rubles. |

|

2011-2012 |

In summer 2011, Rusnano bought 5% of Monocrystal for $42 million, with this package still being their property. They said that Rusnano management wanted to get a controlling stake, but the parties agreed on independent cooperation. A sharp rise in sapphire prices attracted new players to the market: in China alone, dozens of sapphire-growing companies were founded within a short time period, and as soon as in 2011 prices began to decrease and in 2012 they dropped below the 2009 level – to $3,2 per a two inch plate. |

Svetlana-Optoelectronica completed the first stage of the project on expanding the LED production capacity and increased the production capacity to 3.5 million single-watt hyperluminous white LEDs per month, investing 800 million rubles in the project. An estimated payback period – up to 4 years. |

|

2013-2015 |

In 2015, sapphire plates prices dropped to $2. In the same year, the company grew a sapphire monocrystal weighing 300 kg – so far no one has managed to beat the record. |

Profit margin dropped from 15.5% in 2013 to 0.01% in 2014, according to Svetlana-Led report for 2014. The company explained it by decreasing production volumes due to falling sales. In early February, Svetlana-Led increased its credit limit in Rossia Bank dated 2014 to 342 million rubles. Also, the company should pay off debts to Sberbank that amount to 195 million rubles. |

|

2016 |

The company’s share on the market of sapphires for LED amounted to 33% |

Products became too expensive for retail prices; therefore, Svetlana-Led almost completely switched to government orders. Sberbank filed a bankruptcy petition for three companies of the Svetlana Optoelectronica group to the Arbitration Court of St. Petersburg and the Leningrad Region |

Almost from the very beginning, Monocrystal has been involved in the cost-reducing race: according to the company CEO Andrey Kachalov, every year it is reduced by 30%. “Most companies in the sapphire industry have been losing money over the past three years,” said Jerry Chen – general manager of Monocrystal in Taiwan – at a conference in Taipei in spring 2016. According to him, within this time period, three of 12 leading manufacturers of artificial sapphires left the market.

Monocrystal has done almost impossible while simultaneously implementing three points of the profit margin growth и:

- Technological – increasing the crystal weight, while simultaneously reducing the cost of growing it.

- Increasing production capacity.

- Attracting new consumers of its products.

All these made it possible for the company to remain not only profitable, but competitive on the global market as well.

According to market participants, the reason of Svetlana Optoelectronica crisis was a series of managerial mistakes and inflated expectations from the nanotechnological boom.

However to my mind, the key mistake of Svetlana Optoelectronica is a miscalculation of the LED cost. During all these years, the LED cost has been dropping by 25% almost every year. This is an enormous figure for the company with a debt burden, with this burden not decreasing even in profitable 2010-2014 years. The company attributes this to lower production volumes due to lower sales. However, the market has been growing, not falling all these years; most likely, the company just failed to win a share on the civilian market, relying on the state program. The company also failed to perform LED sales through distributors.

At the beginning of the LED lamps era, the cost of LEDs in lamps rarely dropped below 50%; in 2010 it was about 25%; nowadays it is not more than 7%. It is the incorrect forecast of the LEDs cost that brought down the production profit margin. Now it’s easy to say, but to my mind, a strategy of contiguous reorientation to distribution business might save the plant, i.e. supplying customers with a complete range of electronic components, including their LEDs, as well as profiles, boards, lenses, bodies, and sealed lead-ins. Given that the company manufactured lamps, this could become the lowest-cost way.

The debt burden, dropping global prices, lack of distribution channels, hope for the state, and inflexibility led to the sad demise of the Russian LEDs production.

But there are plenty of LEDs consumers in Russia. According to import statistics 2019, over three months, more than 50 customers bought various LED solutions abroad by customs code 854140100* more than $100,000 worth, and the full list includes more than 500 importers. Here are the first 32 on the list.

Table 3. Import to Russia, by consignee, by code 85414* for April, May, and June 2019

|

|

Consignee |

Total |

|

1 |

LG |

833,764 |

|

2 |

Customs broker |

796,860 |

|

3 |

Manufacturer |

759,008 |

|

4 |

Manufacturer |

552,081 |

|

5 |

Manufacturer |

537,591 |

|

6 |

EC distributor |

498,467 |

|

7 |

Manufacturer |

483,876 |

|

8 |

Manufacturer |

444,335 |

|

9 |

Manufacturer |

393,305 |

|

10 |

Customs broker |

361,837 |

|

11 |

EC distributor |

356,016 |

|

12 |

??? |

325,605 |

|

13 |

??? |

311,270 |

|

14 |

EC distributor |

302,834 |

|

15 |

Manufacturer |

299,645 |

|

16 |

Manufacturer |

295,630 |

|

17 |

EC distributor |

294,177 |

|

18 |

EC distributor |

291,553 |

|

19 |

EC distributor |

286,632 |

|

20 |

??? |

281,155 |

|

21 |

Manufacturer |

278,838 |

|

22 |

EC distributor |

275,690 |

|

23 |

Manufacturer |

275,607 |

|

24 |

Manufacturer |

275,375 |

|

25 |

Manufacturer |

254,322 |

|

26 |

Manufacturer |

243,836 |

|

27 |

EC distributor |

227,195 |

|

28 |

Manufacturer |

215,339 |

|

29 |

EC distributor |

211,701 |

|

30 |

EC distributor |

210,742 |

|

31 |

Customs broker |

195,150 |

|

32 |

Manufacturer |

180,694 |

In just three months, various LEDs $18.6 million worth were brought to Russia within this group 854140100*. If we omit LG, whose products supply is used for producing items under its brand, the marker shares by customers with imports from 10,000 USD, is as follows:

1. Distributors, brokers 3.65 million. 26 customers.

2. Consumers 7.2 million. 39 customers.

3. Customs brokers 1.35 million. 3 clients.

4. Unclassified importers 5.4 million. 103 customers.

According to Lightning Business Consulting agency, in 2018 the total of 1003 lighting equipment manufacturers were registered in Russia. If we omit the importers we already know, the remaining 800 small scale customers purchase 3.6 million worth LEDs from 26 distributors and brokers. In fact, the number of such customers is, of course, much higher, since LEDs are also used for producing various electronics, but the consumption volume there is not so large if compared to lighting equipment.

Monocrystal accounts for from 35 to 40% of sapphires for the LED production coming to Russia. But at the time of making a manufacturing decision, it was impossible to predict. According to the owner, the main idea was an intention just to provide load for idle capacity. Nevertheless, the explosive market growth and right decisions had formed the positive trend.

The owners of Svetlana Optoelectronica made a conscious decision based on a pronounced market trend; however, they overestimated their ability to reduce production costs and their ability to repay loans, relied more on an announced state program than on the civilian market. Let’s see the LEDs import by brand, from $200,000, Table 4.

Table 4. Import to Russia, by brand, by code 85414* in April, May, and June 2019.

|

Manufacturer |

Total |

|

OSRAM OPTO SEMICONDUCTOR |

1,663,213 |

|

SHENZHEN MEIYAD OPTOELECTRONICS CO.LTD |

945,386 |

|

SEOUL SEMICONDUCT OR |

873,429 |

|

XIAMEN QIANGLI JUCAI DISPLAY TECHNOLOGY CO. LTD. |

871,320 |

|

EDISON OPTO (DONG GUAN) CO. LTD |

815,905 |

|

SAMSUNG |

815,290 |

|

CREE |

804,393 |

|

IPG PHOTONICS |

630,179 |

|

KINGBRIGHT |

561,836 |

|

SHENZHEN REFOND OPTOELECTRONICS CO. LTD |

521,603 |

|

SHENZHEN DREAM OPTOELECTRONIC TECHNOLOGY CO. LTD |

323,228 |

|

ZHONGSHAN HONGYU EL-TECH CO.LTD |

281,155 |

|

FLYING ELECTRONICS CO LTD. |

278,838 |

|

XUYU OPTOELECTRONICS (SHENZHEN) CO. LTD |

275,375 |

|

EVERLIGHTS ELECTRONICS EUROPE GMBH |

264,734 |

|

NINGBO FORYARD OPTOELECTRONICS CO LTD. |

259,662 |

|

NICHIA CORPORATION |

239,635 |

|

NEW LIFE TECHNOLOGY TRADE LIMITED |

225,082 |

|

SHENZHEN XU AN ELECTRONICS CO.LTD |

222,454 |

|

LG ELECTRONICS |

204,005 |

The following table 5 will be interesting for those who want to penetrate the Russian market.

Table 5, sales depending on the presence of brokers in Russia.

|

Number of brokers |

Number of clients in case of no brokers |

Manufacturer |

|

2 |

|

OSRAM OPTO SEMICONDUCTOR |

|

0 |

2 |

SHENZHEN MEIYAD OPTOELECTRONICS CO.LTD |

|

2 |

|

SEOUL SEMICONDUCT OR |

|

0 |

2 |

XIAMEN QIANGLI JUCAI DISPLAY TECHNOLOGY CO. LTD. |

|

1 |

|

EDISON OPTO (DONG GUAN) CO. LTD |

|

4 |

|

SAMSUNG |

|

3 |

|

CREE |

|

0 |

1 |

IPG PHOTONICS |

|

0 |

1 |

SHENZHEN REFOND OPTOELECTRONICS CO. LTD |

|

4 |

|

KINGBRIGHT |

The first column shows the total number of distributors/brokers importing this brand. The second column tells us how many end-users import it in Russia without any distributors.

As you can see, working through a distributor doesn’t mean that the brand cannot be sold, but without it, the brand’s capabilities are limited to 1-2 large scale customers. Keep in mind that there are about 1000 registered manufacturers in Russia. Those who want to sell much to many in Russia, can’t do without distributors.

And the last Table 6, the country of consignment of the goods.

Table 6. Import to Russia, by country of consignment, by code 85414* in April, May, June 2019

|

Country of consignment |

Total |

|

China (CN) |

9,143,698 |

|

Germany (DE) |

2,776,652 |

|

Hong Kong (HK) |

1,934,342 |

|

South Korea (KR) |

1,449,628 |

|

USA (US) |

1,005,780 |

|

Japan (JP) |

350,349 |

|

Finland (FI) |

305,099 |

|

Estonia (EE) |

250,616 |

|

Netherlands (NL) |

249,277 |

|

Italy (IT) |

153,367 |

The LED lights market

The Russian LED lights market shown in table 7 is already close to its saturation point in terms of the market production volume. According to Light Business Consulting, in 2018, the LED lights share in the market volume grew by 2.1 percentage points in quantitative and by 5.2 percentage points in value terms.

Table 7. The LED lamp market.

|

|

Million pcs |

||

|

2016 |

2017 |

2018 |

|

|

LED |

33.2(63.7%) |

54.2 (84.5%) |

55.2 (86.6%) |

|

Traditional |

18.9(36.3%) |

9.9 (15.5%) |

8.5 (13.4%) |

|

Total |

52.1 |

64.1 |

63.8 |

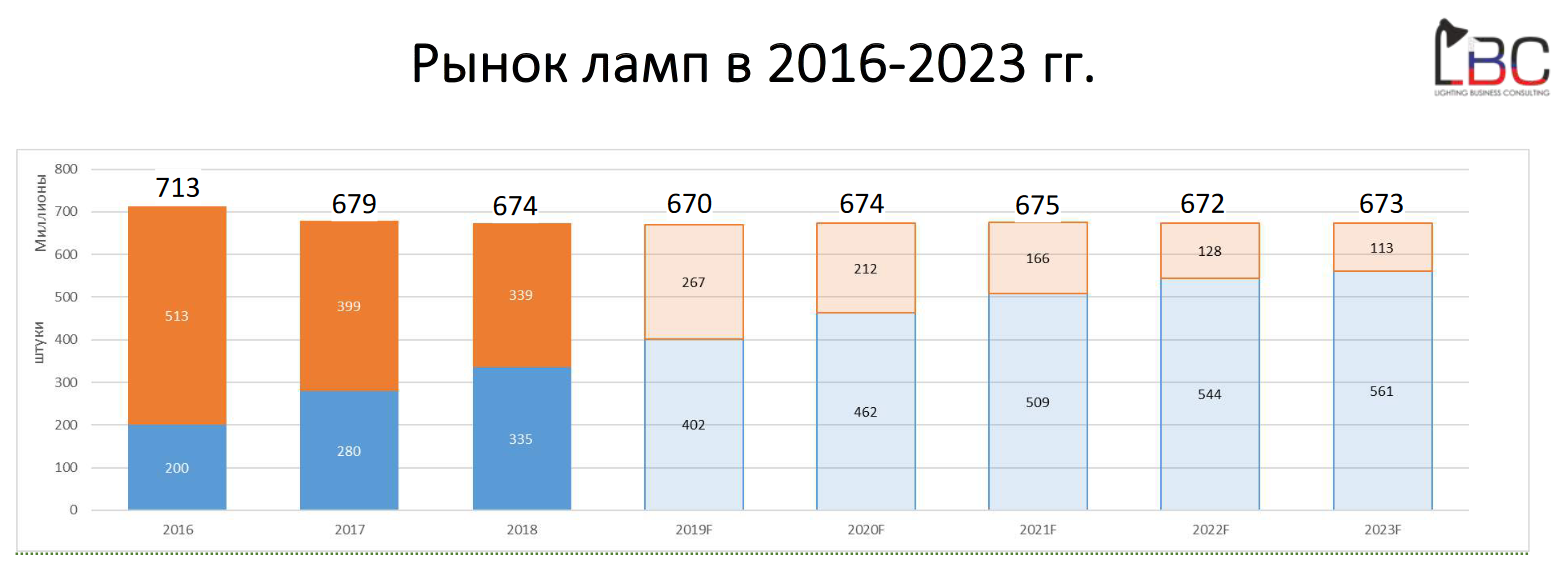

Picture 1. Prospects for development of the Russian LED lights market.

Between 2019 and 2023 an increase in the lights market volume is forecast, see Picture 1. In 2023, the lights market volume will reach as many as 69.1 million pieces, which is 8% more than the lights market volume in 2018. This will mainly be due to state infrastructure programs and a general increase in energy saving degree in the civilian sector.

An additional factor promoting the increase in the LEDs import by 2023-2025 will be a further increase in LED lights consumption. Now, they account for about a half of the total consumption of all kinds of lights in Russia. But the upward trend in consumption is obvious, see Table 8.

Table 8, Consumption growth of LED lamps in Russia.

|

|

Million pcs |

||

|

2016 |

2017 |

2018 |

|

|

LED lamps |

200 |

280 |

335 |

First of all, this is due to the following factors:

1. State incentives for switching to LED products in the public sector.

2. Replacement of nondurable incandescent bulbs with LED bulbs, with a significantly longer service life and fewer replacements per unit of time.

3. Replacement of lights with interchangeable light sources with lights with integrated LED light sources.

4. Reducing the LED bulbs cost and general increase of understanding of energy saving ideas among the population.

The national Russian production of LED bulbs froze at the level of 40-45% of the turnover. The majority of the growth will be more due to an increase in the LED bulbs share in the total lamps share than to replacing the LED bulbs import.