AnalogDevices in Russia. Suppliers and consumers

The global analog integrated circuit (IC) market is currently expected to have an average annual growth rate of 5.5% over the forecast period (2021-2026).

What will contribute to this growth?

First of all, the continued spread of smart phones, functional phones and tablets, base radio stations of the third- and the fourth-generation, RFIC.

Moreover, the sales of specialized analog ICs for autonomous vehicles may grow in future, as new features will appear in cars and the range of existing ones will expand — backup cameras, blind spot sensors and other systems.

AnalogDevices, which is ranked second in the world in terms of analog chips, has every prospect for further organic growth in its sales. Moreover, the company is also expanding sales at the expense of its competitors.

Its annual report specifies: “In addition to organic growth stimulation, our strategy includes expansion through the acquisition of businesses, assets, or technologies that enable us to add new products to existing offers and increase market coverage.”

In accordance with this strategy, AnalogDevices acquired Hittite in 2014 and LinearTechnology in 2017. In 2020, AnalogDevices and MaximIntegrated – major manufacturers of integrated circuits for analog, digital, and mixed signal processing – announced a deal through an acquisition.

This analysis includes only such supplies where AnalogDevices is the manufacturer. A significant part of the import of Hittite and LinearTechnology is also carried out with the indication of this manufacturer, as both companies had been bought long time ago, their rebranding as a whole has been already completed and has become familiar to the market. As for the import of MaximIntegrated, here AnalogDevices is indicated as a manufacturer on a very small scale.

We provide comparative data on the import of these brands, see Table 1.

Table 1. Import by brand in 2020

| Brand | Import, US$ |

| Hittite | 359000 |

| LinearTechnology | 3100000 |

| MaximIntegrated | 11600000 |

| AnalogDevices | 65884531 |

| Total: | 80943531 |

The table shows that the total volume of brands’ import included in the line of AD is almost US$81 million. MaximIntegrated stands apart, as its takeover has been not yet completed. The brands Hittite and Linear account for only 5%, when compared with AnalogDevices’ indices of US$65 million. This data is quite sufficient for analyzing the import structure. It must be borne in mind that the analysis is made only for those US$65.88 million, where the brand AD is specified. I didn’t get the data for the remaining 5%. If you are interested, we can discuss it individually.

It follows from the given figures, that the share of Russia in total sales, without MaximIntegrated, but taking into account other brands, is 1.2%. The data on total AD sales are shown in Table 2.

Table 2. Global AD sales in 2020

| Market | ths., US$ | % |

| Industrial | 2.987.542 | 53 |

| Communications | 1.195.946 | 21 |

| Automotive | 779.27 | 14 |

| Consumer | 640.292 | 11 |

| Итого: | 5.603.057 |

ATTENTION! Data on AD are indicated for the fiscal year ended on October 31, 2020, and import figures are given for the calendar year 2020, in accordance with the accounting measure adopted in Russia.

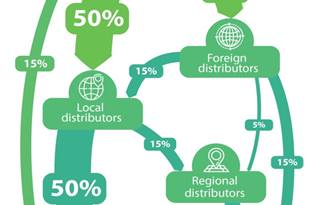

The report also states: “We sell our products worldwide to more than 125,000 end users through direct sales departments, third-party distributors, independent sales representatives, and through our own website. We have direct sales offices, sales representatives, and / or distributors in more than 50 countries outside North America.

The key words here are “direct sales”. Below we will try to estimate their share. This is important for both end users and distributors. Example: recently, a major manufacturer provided a direct account to the Russian end user. As a result, the distribution market for electronic components has been reduced by another US$1 million, and the distributor has difficulties making up for this loss.”

Now we go on to read the report.

“From time to time, we may, for reasons of expediency, increase or decrease the number of distributors in certain geographical regions, as well as transfer customers to a direct support or order fulfillment model. This takes into account our strategies, the level of business activity of distributors, their efficiency and financial condition.

Some distributors also sell products that compete with ours, including those for which we are an alternative source.”

As you know, recently the company COMPEL received distribution on AD, which, in my opinion, is a direct consequence of the loss of distribution on Texas Instruments. I wrote in my article “Texas Instruments in Russia. Revolution or Opportunity “ direct sales strategy is erroneous due to the specifics of our legislation and business practices.

On the other hand, I understand that there are no rules and agreements for a market of 0.3% of global sales. As one interlocutor has recently told me, the decision that Russia would lose the opportunity to have distribution had been made three years before its public disclosure.

I can’t talk about what will happen in the world, but as for Russia, AD will only benefit from this here. And the very fact of obtaining a new distribution indicates that the company understands this perfectly.

Let us go back to direct sales. The transfer of the end customer to direct supplies in any case represents a significant percentage of the risk in the work with the manufacturer (see Table 3).

Table 3. Distribution of global AD sales through sales channels

| Sales channels | ths., US$ | % |

| Distributors | 3.216.302 | 57 |

| Directcustomers | 2.300.493 | 41 |

| Other | 86.261 | 2 |

| 5.603.057 |

The competitive struggle between the two world giants continues. So far, TexasInstruments is the winner in the world. The company maintains its position in the analog IC sector, which accounts for 19% of global sales. But in the long term, the strategy of AD seems to me to be more promising in Russia. TexasInstruments does not have such a gap here from AD, and, quite possibly, even let them be the first. In a similar article about TexasInstruments, this will be demonstrated more clearly, but in the meantime, we will look at the sales of AD in Russia in more details.

AnalogDevices in Russia

Part 1. Consignees

More than 200 companies imported the brand AD to Russia at the amount of US$10,000 or more, so I will divide the importers into 2 groups. Table 4 will show only the suppliers I found, and Table 5 will show only the manufacturers. In both cases, only the suppliers and manufacturers, that have been uniquely found by me, are considered, with the web-sites, if any. Contract manufacturers and transport companies are not included in the tables. They represent only importers with the import sums starting from US$10,000 per year. When you buy the article, you will get data on each of them, but all those whose indices are below US$10,000 will be given without web-sites. The names in the tables are given in transcription, not in literal translation.

Table 4. Importers-suppliers in 2020

| Consignee’s name | Consignee’s tax ID number | Result | Web-site |

| 14479934 | |||

| 11521618 | |||

| 2213399 | |||

| 1950823 | |||

| 1080276 | |||

| 971483 | |||

| 841970 | |||

| 732531 | |||

| 663223 | |||

| 620480 | |||

| OOO “STRELOY Ye-KOMMERTS” | 7840068335 | 571509 | e-streloy.ru |

| 493589 | micro-tech.su | ||

| 465200 | microtopaz. | ||

| 402038 | |||

| 354014 | |||

| 340776 | |||

| 314033 | |||

| 307811 | |||

| 266566 | |||

| 266197 | |||

| 224347 | |||

| 220847 | |||

| 207649 | |||

| 194268 | |||

| 190595 | |||

| 180599 | |||

| 178894 | |||

| 176922 | |||

| 173797 | |||

| 172284 | |||

| 168314 | |||

| 161383 | |||

| 158709 | |||

| 156134 | |||

| 155505 | |||

| 151901 | |||

| 151738 | |||

| 150397 | |||

| 133856 | |||

| 133269 | |||

| 132597 | |||

| 129964 | |||

| 124485 | |||

| 122103 | |||

| 120683 | |||

| 118637 | |||

| 116982 | |||

| 112453 | |||

| 111525 | |||

| 102781 | |||

| 98173 | |||

| 90630 | |||

| 90566 | |||

| 88725 | |||

| 87902 | |||

| 86113 | |||

| 79561 | |||

| 78337 | |||

| 78188 | |||

| 77158 | |||

| 71833 | |||

| 69393 | |||

| 65035 | |||

| 63342 | |||

| 62125 | |||

| 61959 | |||

| 61236 | |||

| 59273 | |||

| 58031 | |||

| 57904 | |||

| 56542 | |||

| 55267 | |||

| 45377 | |||

| 52441 | |||

| 51103 | |||

| 50650 | |||

| 50027 | |||

| 49303 | |||

| 46715 | |||

| 45861 | |||

| 45770 | |||

| 45468 | |||

| 44616 | |||

| 43661 | |||

| 43245 | |||

| 40005 | |||

| 39527 | |||

| 39476 | |||

| 38798 | |||

| 38765 | |||

| 37796 | |||

| 37115 | |||

| 35762 | |||

| 35673 | |||

| 35195 | |||

| 34573 | |||

| 33990 | |||

| 33753 | |||

| 33696 | |||

| 33384 | |||

| 32939 | |||

| 29841 | |||

| 28805 | |||

| 28033 | |||

| 27286 | |||

| 26790 | |||

| 26598 | |||

| 26452 | |||

| 26336 | |||

| 26178 | |||

| 25935 | |||

| 22615 | |||

| 20317 | |||

| 18205 | |||

| 17388 | |||

| 16198 | |||

| 14989 | |||

| 13152 | |||

| 12805 | |||

| 11701 | |||

| AO “APPARATURA SISTEM SVYAZI” | 7733118260 | 10345 | escltd.ru |

| Total: | 4671308 |

Table 5. Importers-manufacturers in 2020

| Consignee’s name | Consignee’s tax ID number | Result | Web-site |

| 1227273 | |||

| 1082376 | |||

| OOO “DIDZHIKOM” | 7719264566 | 1030300 | dg-com.ru |

| 571235 | |||

| 544458 | |||

| 443797 | |||

| 382028 | |||

| 344794 | |||

| 322665 | |||

| 306006 | |||

| 278034 | |||

| 245105 | |||

| 188255 | |||

| 168500 | |||

| 150155 | |||

| 107148 | |||

| 105119 | |||

| 94984 | |||

| 69846 | |||

| 58702 | |||

| 57661 | |||

| 55211 | |||

| 41235 | |||

| 40297 | |||

| 38802 | |||

| 33000 | |||

| 29619 | |||

| 29298 | |||

| 27154 | |||

| 27000 | |||

| 25475 | |||

| AO MORDOVSKAYA RADIOELEKTRONNAYA KOMPANIYA | 1324000130 | 19072 | none |

| Итого | 8144606 |

The summary data is presented in Table 6.

Table 6. Summary data on importers

| Type | Result | % |

| Suppliers from 10,000 | 46713037 | 70.90137 |

| All others: suppliers and manufacturers up to 10,000, Doubtful, IT Distributors, Customs brokers. | 10036888 | 15.23406 |

| Manufacturers, including contract manufacturing | 9134606 | 13.86457 |

| Total: | 65884531 | 100 |

From the data provided, it is clearly seen that only 13% of all imports by AD account for the supply of manufacturers’ own foreign trade departments. Taking into account the globalists, at least 80% of the brand AD is delivered through intermediaries.

If you buy the article, you can see yourself how much is accounted for by Russian distributors, how much is accounted for by globalist senders, and how much is accounted for by companies like yours. I will only note that, surprisingly, a lot of. So, the brand AD is positioned as a very competitive supplier. The question is in the sources-suppliers and the analysis of lack of your sales.

Part 2. Suppliers

If you have read my article and made the appropriate conclusions, then sooner or later you will have a list of items that your customers consume, but that your company does not supply. Judging by the wide list of suppliers-importers, the price policy of AD in Russia allows you to make deliveries directly, bypassing distributors, as well as buying from them. The only question is where to buy, and my following table will help you with this. Table 7 shows AD suppliers, the importers listed in Tables 5 and 6 had bought from.

Table 7

| Supplier’s name | Web-site | Result |

| ANALOG DEVICES C/O | analog.com | 24873143 |

| 4544355 | ||

| 3974935 | ||

| 1761361 | ||

| 1739322 | ||

| 1277081 | ||

| 1212093 | ||

| 1160310 | ||

| 1137435 | ||

| 1063940 | ||

| 966623 | ||

| 920486 | ||

| 777403 | ||

| 745477 | ||

| 731989 | ||

| 724623 | ||

| 708912 | ||

| 599635 | ||

| 543872 | ||

| 444537 | ||

| 438481 | ||

| 419824 | ||

| 370223 | ||

| 352693 | ||

| 294169 | ||

| 279487 | ||

| 268550 | ||

| 247914 | ||

| 221197 | ||

| 216849 | ||

| 170077 | ||

| 161260 | ||

| 133333 | ||

| 130242 | ||

| 129254 | ||

| 117730 | ||

| 113333 | ||

| 110729 | ||

| 105174 | ||

| 100590 | ||

| 98893 | ||

| 87525 | ||

| 72199 | ||

| 70761 | ||

| 58414 | ||

| 55451 | ||

| 47805 | ||

| 45821 | ||

| 43525 | ||

| 38798 | ||

| 38456 | ||

| 35164 | ||

| AELCOMP OY | aelcomp.com | 33895 |

I left the first 25 places unchanged, then added only those consignors which could be identified as suppliers or whose web-site could be found, although I admit that some of them may be companies owned by Russian suppliers. When buying the article, you will receive all the consignors as they are.

As you can see from the consignors, at least 25 million are accounted for by direct deliveries from the manufacturer, including the Russian and global distributors.

Now let us see how much of AD supplies come from the Russian distributors. To do this, we will study the consignees of the supplier ANALOG DEVICES C/O, see Table 8.

Table 8. Consignees of the production from the supplier ANALOG DEVICES C/O

| Consignee’s name | Direct supplies from AD | All the supplies |

| 14397267 | 14479934 | |

| 11521162 | 11521618 | |

| Direct delivery to the manufacturer | 166805 | |

| 0 | 2230713 |

Everything is fine here. AD directly delivers the goods only to one consumer In Russia; all other supplies go through distributors. Another thing is that Russian distributors, excluding Compel, are accounted for by less than half of AD imports to Russia.

Next year, it will be possible to consider Compel, and taking into account the supplies of Maxim, most likely, it will take the 1st place. Here it is necessary to take into account that Compel itself, in addition to purchases from global distributors, bought a lot directly from Teson and Eltech. I can confidently say that Eltech and Teson will have temporary drawdowns in AD sales, no matter what plans they give their managers. In the next couple of years, this is inevitable. The growth reserve for them is hidden in Table 6. Compel has Maxim, 2 million of its own import, another 1 million, and according to rumors, also 2 — purchases from Eltech and Teson, and now, without losing all this, it gets an official status.

I am surprised that neither Teson nor Eltech use global distributors in their supplies, because if you look at Table 4, they are accounted for by at least 7.3 million of direct import to Russia. In reality, this figure is higher, due to the fact that many companies have foreign parts that consolidate cargo from different suppliers. In this respect, Compel has a great advantage.

What conclusion can be drawn from the article in terms of supplies? In this regard if we take AD, everything is somehow very balanced, which is very attractive for the consumer.

I liked the article. Please put the plus sign in linkedin.

The cost of the article with data 500 EUR