Infineon purchases Cypress. Analysis of the Russian market.

Information about semiconductor giant Infineon Technologies purchasing Cypress Semiconductor was published on Infineon website back in 2019, but completion of this deal raised major concerns after it was recommended to Donald Trump to block the deal for the national security reasons. A year earlier, they had already prohibited Infineon to purchase the American company.

But on March 9 of the current year, on Cypress manufacturer’s page appeared a statement informing that CFIUS had completed analyzing the previously announced merger of Cypress and Infineon Technologies, with the committee seeing no unresolved issues related to the national security ” . We can take it that there are almost no obstacles to complete a merger with Infineon Technologies.

I was surprised by the lack of information about regional Russian distributors – there is a scope of global distributors working on the market. Nevertheless, the Cypress brand is a well-known trademark in Russia specializing in the following product types:

- Storage chips: synchronous and asynchronous SRAM, non-volatile memory, dual-port SRAM.

- Interface microcircuits and USB controllers: hosts, hubs, transceivers, bridges.

- Configurable systems-on-chip – Programmable System-on-Chip (PSoC);

- LED power and control microcircuits.

- Controllers of touch buttons and screens.

- Synchronization systems microcircuits.

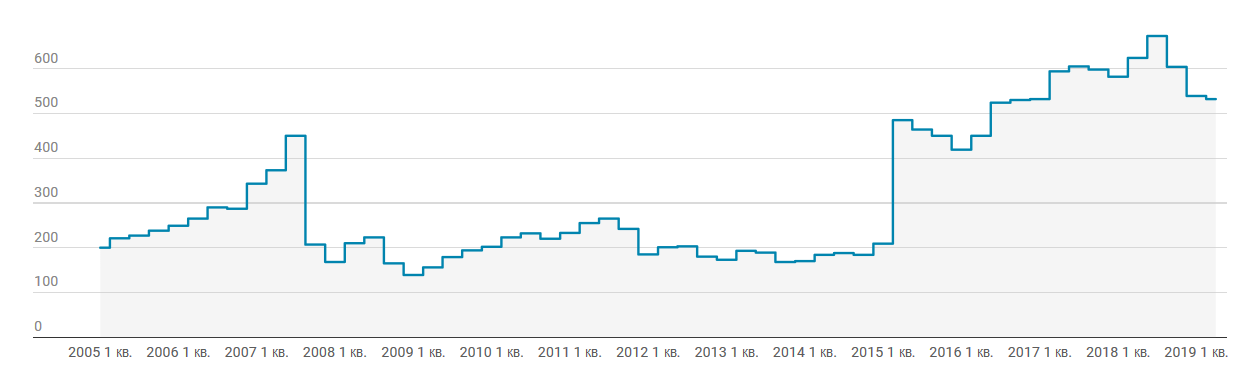

Microcontrollers account for more than a half of Cypress revenue. In general, the company occupies extremely confident position on the market, but business is business. Moreover, Cypress has already undergone a merger procedure when mergering with Spansion. That time, the merger was a consolidation of two leaders, with each being Number 1 on their memory markets. It was an extremely successful deal for Cypress (see Picture 1). By the time the deal had been completed – in the second quarter 2015, the company’s more than doubled.

Figure 1. Cypress Semiconductor quarterly revenue. In million dollars.

Acquiring the taste of success, in 2015 Cypress tried to purchase Integrated Silicon Solution Inc., but a competitor offered more. In the same year, Cypress made another attempt – to buy Atmel, but it failed to come to an agreement. It managed to win in 2016, with Cypress in April announcing the acquisition of Broadcom Wireless Internet of Things (IoT) business.

In 2017, the company suffered from an internal corporate conflict and had other things to worry about instead of new purchases.

Infineon Technologies appeared after Siemens AG’s semiconductor business detached as a separate company. In 2004, Infineon purchased ADMtek. Now no one remembers it now, but once ADMtek used to be one of the leading suppliers of broadband access microcircuits. Then followed a forced 10-year vacation and in 2014, Infineon Technologies agreed to purchase International Rectifier, which was the most remarkable news on the Russian market. In 2016, Infineon wanted to buy Wolfspeed from Cree Inc. But the deal wasn’t approved by the US National Security Committee. And in June 2019 only, Infineon announced the purchase of Cypress Semiconductors. In the ranking by IC Insights research company, Infineon ranks 13th. In Russia, Infineon has an excellent sales volume and decent regional distributors, such as Efo, Kompel, and Symmetron.

Thus, let’s have a look at the FOB import of Cypress and Infineon brands to the Russian Federation, Table 1.

Table 1. The FOB import volume, 2019, USD.

|

Manufacturer |

2019 |

|

INFINEON TECHNOLOGY |

37,000,000 |

|

CYPRESS SEMICONDUCTOR |

6,500,000 |

Since information processing requires substantial resources, I would take a liberty of limiting he analysis to certain customs codes, Table 2.

Table 2. Customs code used for presenting data in the second part of the article.

|

Customs code |

Description |

|

8542319010 |

Integrated circuits, monolithic |

|

8541290000 |

Other transistors, except phototransistors |

|

8542399010 |

Integrated circuits, monolithic |

|

8541100009 |

Other diodes, except photodiodes or light emitting diodes (LED) |

|

8541409000 |

Semiconducting photoresponsive devices, including photogalvanic cells, assembled or not assembled in modules, inbuilt or not inbuilt in panels; light emitting diodes, others |

|

8542324500 |

Static random-access memory (SRAM), random access cache memory |

|

8542329000 |

Memory devices, others |

|

8542326100 |

Flash PROM with memory capacity not exceeding 512 MB |

These codes account for the major part of the import volume, see Table 3.

Table 3. FOB import of Cypress and Infineon in 2019 under the Table 2 codes, USD.

|

Manufacturer |

Total |

|

INFINEON TECHNOLOGY |

33,500,000 |

|

CYPRESS SEMICONDUCTOR |

4,600,000 |

The Russian market of electronic components is unique. Russia is one of few countries whose market belongs to local companies. They dominate over global distributors. More than 50 large-scale companies are engaged in electronic components distribution on the Russian market, to say nothing of regional dealers. There are more than 200 intermediaries on my brokers list, including the entire market diversity – from distributors to the smallest brokers.

The mentioned feature leaves its traces on almost any brand, with INFINEON and CYPRESS being no exception here. See Table 4

Table 4. Distribution of import ranks by consumer type.

|

INFINEON TECHNOLOGY |

CYPRESS SEMICONDUCTOR |

||

|

№ |

Status |

№ |

Status |

|

1 |

Intermediary |

1 |

Intermediary |

|

2 |

Intermediary |

2 |

Intermediary |

|

3 |

Intermediary |

3 |

Intermediary |

|

4 |

Intermediary |

4 |

Customs broker |

|

5 |

Manufacturer |

5 |

Intermediary |

|

6 |

Manufacturer |

6 |

Intermediary |

|

7 |

Manufacturer |

7 |

Intermediary |

|

8 |

Intermediary |

8 |

Intermediary |

|

9 |

Customs broker |

9 |

Manufacturer |

|

10 |

Manufacturer |

10 |

Intermediary |

|

11 |

Manufacturer |

11 |

Manufacturer |

|

12 |

Manufacturer |

12 |

Manufacturer |

|

13 |

Intermediary |

13 |

Intermediary |

|

14 |

Intermediary |

14 |

Intermediary |

|

15 |

Intermediary |

15 |

Intermediary |

|

16 |

Intermediary |

16 |

Intermediary |

|

17 |

Intermediary |

17 |

Manufacturer |

|

18 |

Manufacturer |

18 |

Intermediary |

|

19 |

Intermediary |

19 |

Intermediary |

|

20 |

Manufacturer |

20 |

Manufacturer |

Distributors account for 2/3 of INFINEON’s import, with various brokers accounting for another 30% of the remaining 1/3. At CYPRESS, intermediaries account for only 50% of import volume, which is due to the lack of distributors and consequently, a demand creation policy.

According to the information on INFINEON website, it becomes obvious that the driving criteria for the purchase were as follows:

1. Cypress’ assets in the form of a differentiated portfolio of microcontrollers.

2. Assets of software and auxiliary components, which to a large extent complement Infineon offer consisting of power semiconductor devices, sensors and security solutions.

3. Infineon expects to achieve significant scale effect due to increasing business scale.

4. After the deal Infineon will become number eighth chip manufacturer in the world, as well as the largest chip supplier on the auto market.

These reasons are offered as the main ones in all the news, but there are two unremarkable lines from the company’s website that have been omitted by many news resources.

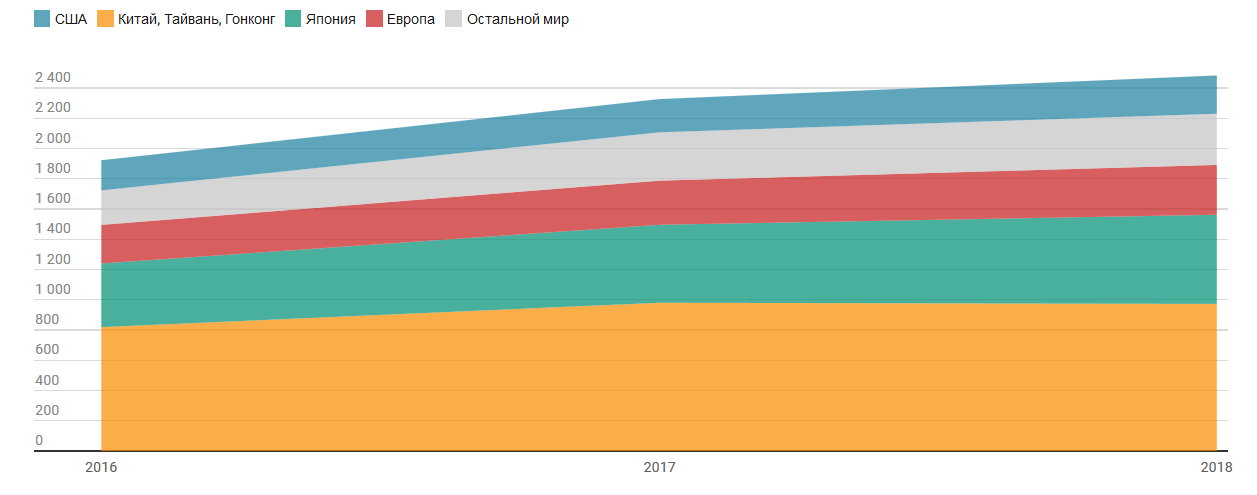

Infineon not only strengthens its capabilities in North America (where Cypress has a confident position), but gains a market share on the strategically important Japanese market as well. I am sure that it was one of the most important purchase criteria, see Picture 2.

Picture 2. Cypress sales by regions, in million dollars.

On the basis of the next table, you will be able to estimate the strengthening of Infineon on the non-strategic Russian market. The sales market in Russia doesn’t always coincide with the global one due to the special features of the national electronic industry and the market as a whole. The more interesting it will be to evaluate it, see Table 5.

Table 5 Joint sales volume by customs codes.

| Customs code | Manufacturer | Total |

| 8542319010 | INFINEON TECHNOLOGY | 14600000 |

| CYPRESS SEMICONDUCTOR | 525000 | |

| 8541290000 | INFINEON TECHNOLOGY | 14040000 |

| 8542399010 | INFINEON TECHNOLOGY | 3300000 |

| CYPRESS SEMICONDUCTOR | 524000 | |

| 8542324500 | CYPRESS SEMICONDUCTOR | 2110000 |

| 8542329000 | CYPRESS SEMICONDUCTOR | 950000 |

| 8541100009 | INFINEON TECHNOLOGY | 858000 |

| 8541409000 | INFINEON TECHNOLOGY | 803000 |

| 8542326100 | CYPRESS SEMICONDUCTOR | 539000 |

At most, microcontrollers are imported into Russia under customs code 8542319010 (Integrated circuits, monolithic); under this code a huge number of crystals for smart cards or the cards themselves are imported. You can find more details about the microcontroller market analysis in my article “Analysis of the microcontroller market”. As far as microcontrollers are concerned, Infineon acquire no significant strengthening – other brands dominate the market.

On the Russian market, Infineon company is considerably strong in the context of static random-access memory devices, other storage devices and Flash PROMs with memory capacity not exceeding 512 MB. Infineon wasn’t previously represented in Russia within this group and now receives a new competitive product group. Russian distributors have already appreciated new opportunities – a well-known brand, product groups that are popular and useful for customers. It’s difficult to judge about the whole world, but in Russia new market shares are waiting for Infineon.

https://journal.tinkoff.ru/news/idea-cy/

https://www.infineon.com/cms/en/about-infineon/press/press-releases/2019/INFXX201906-074.html