Market Share of Chinese Manufacturers in Russia. Examples.

The article was published in “KOMPONENTY I TEKHNOLOGII” magazine • #8, 2019

Have you often had to choose a European brand to find a new growing point for your business? Or to consider what you should better buy? Over my 14 years in supplies of electronic components, I have had to do it almost every quarter. I relied on my intuition, demand, experience and stock analysis. And since 2016, there has been one more factor to be considered: the Customs Service started publishing their official data for reference. The information can be used to get a fair picture based on the data you need and find out the exact share of your business in the country by a particular code. Here, we will try to answer the following question: what percentage share in terms of money and weight is occupied by European and Chinese electronic component manufactures? As for money, it is quite clear. But what about the weight?

One day, I got two identical 12-pin connectors on my table. The first one was made by a world-famous brand while the other one was from a little-known Chinese manufacturer. Both brands were in my charge. I took the samples and went to our engineers. Without my comments, eight people out of nine chose the Chinese brand. That’s curious, I thought to myself.

It was then when I had the idea: how can the share occupied by each of them be determined? After all, they differed in price by 3 times and were identical by their technical characteristics. It is also remarkable that the world brand’s factory was also located in China. What do those items have in common? Only weight. Their price can be several times different while the difference in their weight does not exceed 10%.

Now, let us see the correlation using two examples and then I will tell you what else we can get. There is no need to describe how to generate reports, the experience is only practical. I will show you the result.

Report 1

Period: January 1, 2018 – June 30, 2018

Code 8504509500 – induction coils and other inductors.

Variant A

Coils under this code totaling to $21.8 mln were imported to Russia over six months. The manufacture related data provided in the tables are not quite correct; I am showing their formation as they are presented in Excel. In declarations, the name of the manufacturing company is indicated in different ways: EPCOS AG, EPCOS HUNGARY, EPCOS (ZHUHAI FTZ) CO LTD – 49 variants in total. The results require additional processing, therefore we provide the writing displayed on the screen for illustrative purposes (Tab. 1). The manufacturers have been selected on a sampling basis; their numbers coincide with the real sequence. As can be seen from Table 2, only 30% of inductors, or to be precise, of the products imported under the code, are made in China. But if we compare the country of origin and the country of dispatch, we will get a very interesting picture (Table 3).

Table 1 Table 2 Table 3

Table 1. Analysis of import of goods under code 8504509500 in the first half of 2018 broken down by manufacturers

Table 2. Analysis of import of goods under code 8504509500 in the first half of 2018 broken down by countries of manufacture

Table 3. Analysis of import of goods under code 8504509500 in the first half of 2018 broken down by countries of manufacture/ dispatch

Thus, the total $6 mln of coils comprise only $2 mln of those supplied directly from China while the remaining $4 mln are shipped to other countries and are delivered to Russia from there. It is improbable that Chinese manufacturers send their products to Russia via, for example, Lithuania, instead of using direct traffic from China, therefore, it is highly likely that the amount of $2.2 refers to Chinese manufacturers.

Then, we prepare a new special report about the country of dispatch and the manufacturer. I do not provide it here but the largest producer I know is HAINING FERRIWO (with its head office in Zhenjiang, China). There is also HONEYWELL with $30,000. The report shows that my assumption that European brands seldom have goods shipped directly from China is quite reasonable. They just do not have any consolidation centers for their products from all factories scattered all over the world. Only manufacture. Simply said, $2.2 mln is the figure showing Chinese manufacturers’ direct share (products under code 8504509500). In other words, the market share of Chinese manufacturers in Russia is 10%.

What conclusion can be made? If you get a franchise, you can choose a product line by a Chinese manufacturer but rely on a European brand keeping the European brand products in stock and some Chinese products as samples. Perhaps, weight will give us a surprise? No, everything is quite predictable.

CN/CN gross weight: 158,947 kg.

All the rest: 958,631 kg.

You may be wondering why Russia is indicated when importing to Russia? I don’t know! It is ххххх, OJSC. The country of dispatch is the Czech Republic. The “Products” section at the receiver’s website says, “Custom-made”. Perhaps, they supply Russian transformers to the Czech Republic according to the Russian standards and install them into modules in Czechia or vice versa.

Variant B

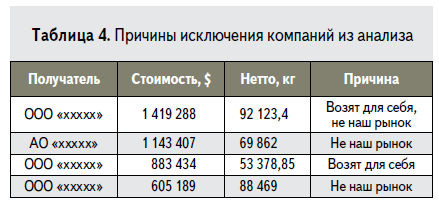

Table 4. Reasons for excluding companies

from the analysis.

An authentic analysis without any complements is provided above as is. It will be Variant B. After a brief review, I would remove the receivers listed in Table 4 from my study and after a more detailed review, I would also exclude some more. There may be different views of what “not our market” is. In this case, we just cannot supply our components there because they are missing in the product range or for some other reasons. If we remove those companies which account for substantial $4 mln, the share of Chinese manufacturers will reach 13% and in total weight – up to 24%. In my opinion, if we review all the statistics thoroughly, we will get 20% in terms of money and 35% in weight. It is up to you to decide which option to choose. Perhaps, after some time, you will develop an approach of your own to generate variants C, D or E.

Report 2

Period: January 1, 2018 – June 30, 2018

Code 8536693000 – pin connectors from my example.

Variant A

Pins under this code totaling to $11.2 mln were imported to Russia over six months.

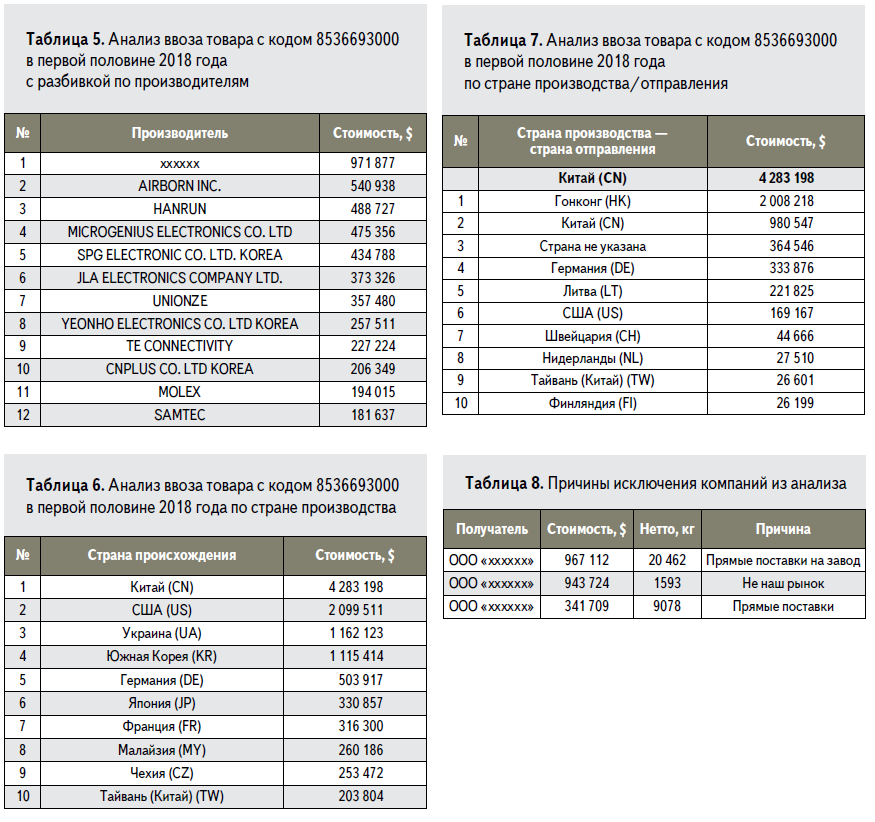

Let us perform the same operations (Tab. 5–7).

We add up China and Hong Kong and obtain $3 mln or 26% in monetary terms. 25% is the result in weight.

CN/CN gross weight: 20,586 kg.

All the rest: 79,556 kg.

Table 5. Analysis of import of goods under code 8536693000 in the first half of 2018 broken down by manufacturers

Table 6. Analysis of import of goods under code 8536693000 in the first half of 2018 broken down by countries of manufacture

Table 7. Analysis of import of goods under code 8536693000 in the first half of 2018 broken down by countries of manufacture/ dispatch

Table 8. Reasons for excluding companies from the analysis.

Table 5. Table 7. Table 6. Table 8.

Table 6. Table 8.

Variant B

We remove what is inapplicable as described in the “Reason” column (Tab. 8).

Subtract $2.2 mln from $11.2 mln at once.

The result is $3 mln or 33% in monetary terms and 42% in weight.

CN/CN gross weight: 20,586 kg.

All the rest: 48,556 kg.

My personal opinion: if all the statistics is reviewed thoroughly, the data obtained will be about 38% in terms of money and 60% in terms of weight.

Since Chinese products are always cheaper while the weight is approximately the same, the correlation may lead us to the conclusion that Chinese manufacturers supply 2/3 of all pin connectors in terms of quantity but only 1/3 in monetary terms.

The conclusion is obvious: Chinese manufacturers have to be included in your product range under the code while European producers should be chosen very carefully. Their prices should be as low as possible and have to be specified before an agreement is signed.

I am sure that business leaders may have another vision of the reports but they hardly have to hold any connectors in their hands like I do. As for me, I have a more precise view of the situation due to some specific features of my work. The challenges I have to meet form numerous bricks of the wall the manager mounts the roof on but, in any case, we are building the same house. And this analysis which originated from my considerations of the two pins I came across is one of those bricks.